Alright, let’s talk about the exciting part of investing in apartment syndications—watching your money grow.

I know you’re a numbers guy, so let’s get right into the returns, profit breakdowns, and real-world examples of what you can expect when investing in a syndication.

Spoiler alert: It’s pretty sweet.

How Your Investment Grows in an Apartment Syndication

How Your Investment Grows in an Apartment Syndication

When you invest in a syndication, your money isn’t just sitting in a bank account collecting pathetic 0.5% interest. It’s working in three major ways:

1. Cash Flow – Getting Paid While You Wait

Think of cash flow as your quarterly “thank you” checks from the rental income.

Tenants pay rent.

Tenants pay rent.

The syndication covers expenses (mortgage, maintenance, etc.).

The syndication covers expenses (mortgage, maintenance, etc.).

The rest is split among investors.

The rest is split among investors.

Typical cash flow: 6%-8% annual return paid out quarterly.

Example:

Example:

- You invest $100,000 in a syndication.

- At a 7% cash flow return, you’d get $7,000 per year (or $1,750 every quarter).

Research: Historical apartment cash flow returns range from 6%-10% (CBRE Research).

Research: Historical apartment cash flow returns range from 6%-10% (CBRE Research).

2. Appreciation – The Big Payday at the End

While you’re collecting cash flow, the syndicator is improving the property—renovating units, upgrading amenities, and increasing rent.

Once the property sells in 5-7 years, you cash out in a big way.

Property value goes up.

Property value goes up.

You get your original investment back.

You get your original investment back.

You collect big profits on top.

You collect big profits on top.

Research: U.S. multifamily properties appreciate at 4%-6% per year on average (Federal Reserve Data).

Research: U.S. multifamily properties appreciate at 4%-6% per year on average (Federal Reserve Data).

Example:

Example:

- You invest $100,000.

- The syndicator increases value by 50% in 5 years.

- When it sells, your total return is $180,000-$200,000.

3. Loan Paydown – Building Equity Without Lifting a Finger

Syndications use leverage (bank loans) to buy apartment buildings. The beauty? The tenants pay down that loan for you.

Every month, rental income covers the mortgage.

Every month, rental income covers the mortgage.

Every month, the loan gets smaller.

Every month, the loan gets smaller.

Your equity in the property grows automatically.

Your equity in the property grows automatically.

Example:

Example:

- The syndication takes out a $10M loan.

- Over 5 years, $1M-$2M of that debt is paid down.

- That extra equity goes straight to investors at the sale.

Research: The average loan paydown adds 2%-4% to annual returns (Freddie Mac).

Research: The average loan paydown adds 2%-4% to annual returns (Freddie Mac).

What Returns Can You Expect?

What Returns Can You Expect?

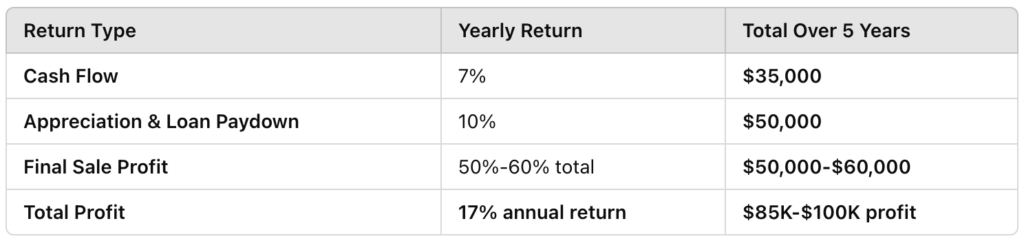

Most apartment syndications target 15%-20% annual returns, when you add up:

Cash Flow: 6%-8% per year

Cash Flow: 6%-8% per year

Appreciation + Loan Paydown: 7%-12% per year

Appreciation + Loan Paydown: 7%-12% per year

Total Returns: 15%-20% average annualized return

Total Returns: 15%-20% average annualized return

Research: Historical multifamily returns have averaged 17% per year, outpacing the S&P 500 (NCREIF Index).

Research: Historical multifamily returns have averaged 17% per year, outpacing the S&P 500 (NCREIF Index).

Example Syndication Deal – $100K Investment

Example Syndication Deal – $100K Investment

How Your Investment Grows in an Apartment Syndication

How Your Investment Grows in an Apartment Syndication  Tenants pay rent.

Tenants pay rent. Example:

Example: Research: Historical apartment cash flow returns range from 6%-10% (CBRE Research).

Research: Historical apartment cash flow returns range from 6%-10% (CBRE Research). What Returns Can You Expect?

What Returns Can You Expect? Cash Flow: 6%-8% per year

Cash Flow: 6%-8% per year

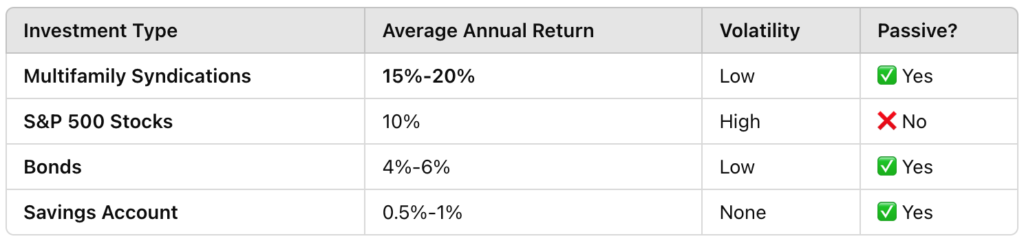

How Does This Compare to Other Investments?

How Does This Compare to Other Investments?

The Best Part? These Returns Are Tax-Advantaged

The Best Part? These Returns Are Tax-Advantaged Final Thoughts – Why Syndications Are One of the Best Investments

Final Thoughts – Why Syndications Are One of the Best Investments